crypto tax calculator australia

Crypto-to-crypto trades are taxable events in Australia. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

The tax rate on this particular bracket is 325.

. Crypto cost basis method Australia. We review your data. You simply import all your transaction history and export your report.

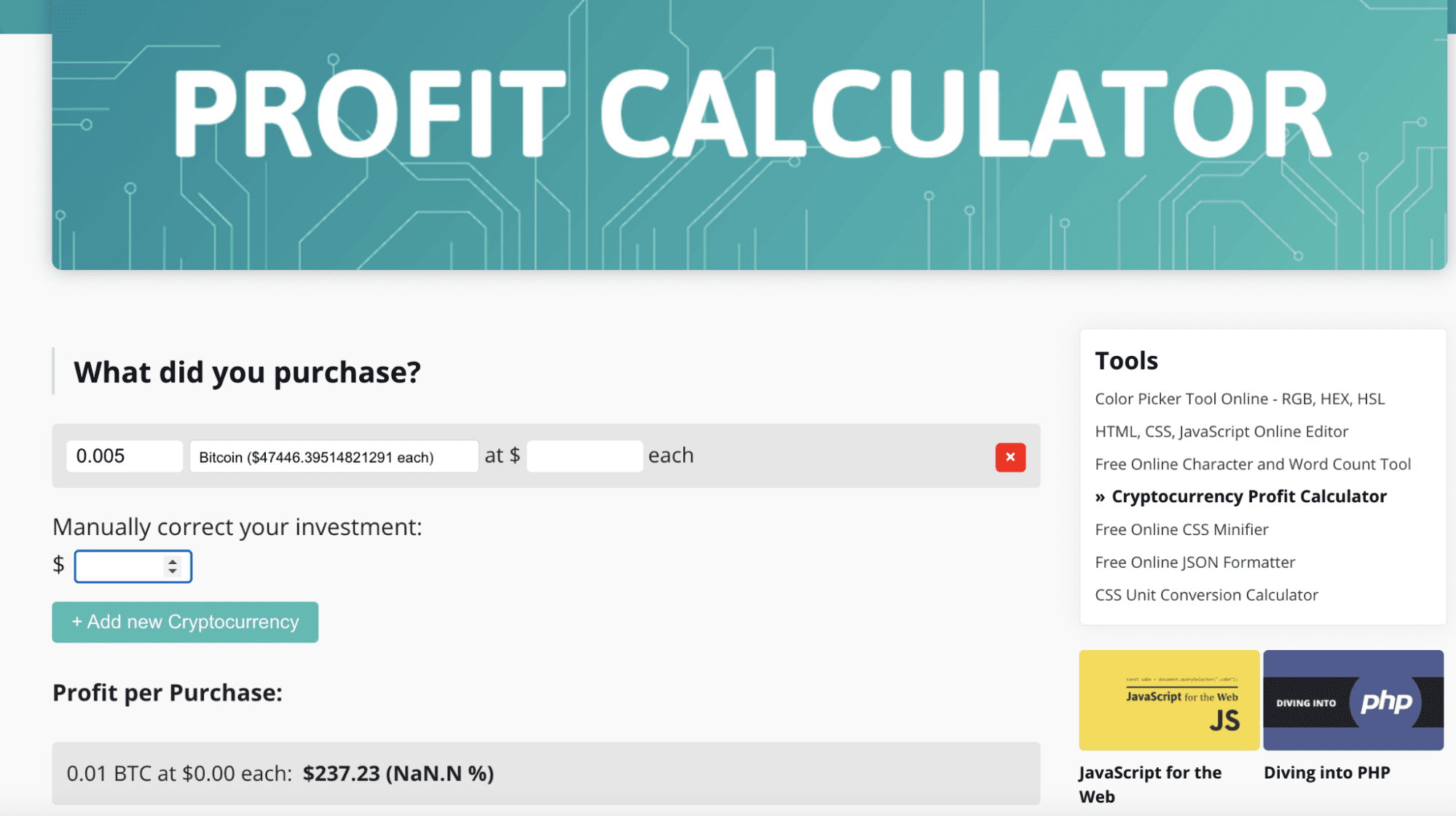

You simply review your. Crypto Tax Calculator Australia Use the free crypto tax calculator below to estimate how much CGT you may need to pay on your crypto asset sale. TokenTax - Supports data from every exchange and wallet.

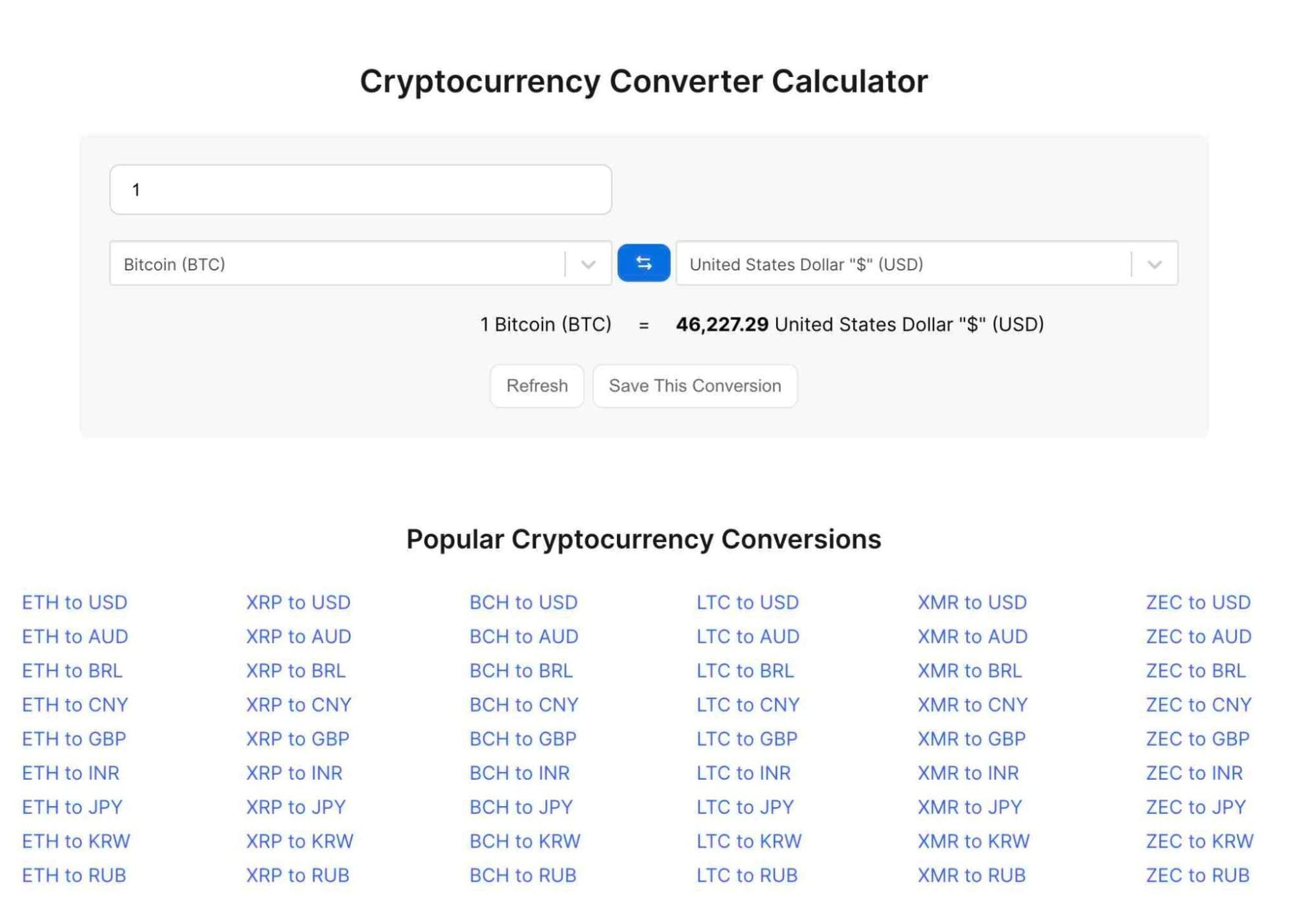

This calculator only provides an indicative estimate based on data you have input and the tax brackets and rates found on. You buy another Bitcoin for 10000. Ill talk this kind of asset class.

You acquire it for less than 10000. As an investor you can use either FIFO HIFO or LIFO to calculate capital gains as long as you can individually identify your cryptocurrency. This means you can get your books.

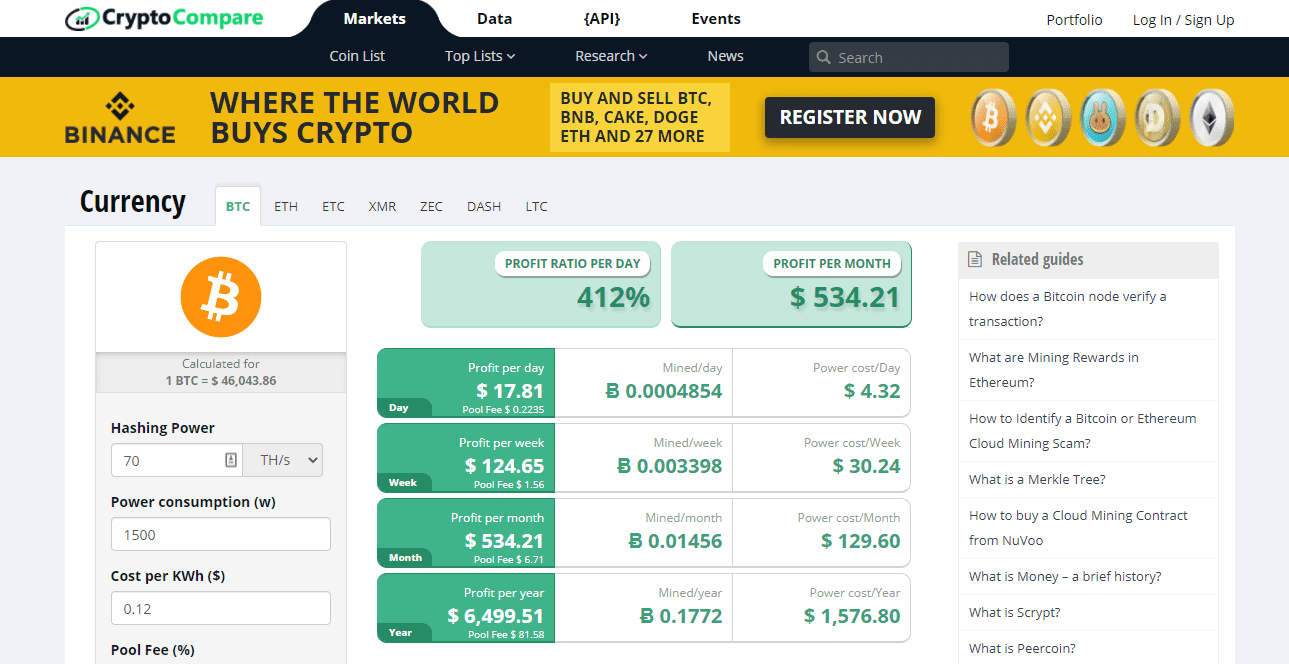

You make a capital gain of 5000 on your first transaction. 19 tax on income between AU18201 to AU45000 which come to AU5092. Send everything you have to us we import it all and help identify issues and walk you through the data.

CoinLedger - Best crypto tax software overall. Coinpanda is one of the most. Australia has the third-highest rate of crypto owners above 17.

Because of the current inflow of crypto traders looking for to diversify. Koinly - Lowest cost at 41 AUD with our 30 discount link CoinTracker. File your crypto taxes in Australia Learn how to calculate and file your taxes if you live in Australia.

Australian citizens have to report their capital gains from. Yes you can CryptoTaxCalculatorAustralia is designed to generate easy tax reports. Compliant with Australian tax rules.

Any crypto sale for crypto or FIAT made as an investment from an individual is subject to capital gains taxes. Possibility sector fund QOZF which include 10-year tax-unfastened boom. June 27 2022.

Quick simple and reliable. Therefore our crypto tax application does not store or keep your crypto data. A capital gain on the disposal of a crypto asset is disregarded if both.

If you want to take advantage of the CGT discount the best option is to use a cryptocurrency tax calculator to do all the calculations for you. 5 tax on income from AU45001 to AU70000 which equals to AU8125 in this case. All reviews product transaction issue support team customer service exchange service wallet question software crypto year one platform problem help.

Calculate Your Crypto DeFi and NFT Taxes in Minutes. The Australian Taxation Office. At Crypto Tax Calculator Australia we support and strongly believe in customer privacy.

In Australia cryptocurrencies are subject to the same tax laws as traditional currencies. Australias Leading Crypto Tax Tool. Capital gains tax report.

If you sell or swap your cryptocurrency. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales you. Crypto tax platforms can help in ways to calculate your capital gains track Bitcoin prices at specific datestimes for personal income tax returns and company transaction reporting.

A capital gain on a personal use asset is not disregarded if it cost you more than. Then sell it for 8000 two months later. Straightforward UI which you get your crypto taxes done in seconds at no.

Thats a capital loss of 2000 on the second. Only capital gains you make from disposing of personal use assets acquired for less than 10000 are disregarded for capital gains tax purposes. You simply import all your transaction history and export your report.

Crypto Tax Calculator is an Australian-based crypto tax software platform that operates with a subscription model allowing you to calculate taxes for previous tax years. This means you can get your tax.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

How To Buy Cryptocurrency In Australia Buy Cryptocurrency How To Become Rich Bitcoin

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Best Cryptocurrency Calculator Mining Profit Taxes

Calculate Your Crypto Taxes With Ease Koinly

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

Best Cryptocurrency Calculator Mining Profit Taxes

Malta Based Stasis Launches New Euro Backed Stablecoin Euro Bitcoin Bitcoin Price

How To Calculate Crypto Taxes Koinly

Bitcoin Price Prediction Today Usd Authentic For 2025

Cryptoreports Google Workspace Marketplace

Calculate Your Crypto Taxes With Ease Koinly

Best Crypto Tax Software Top Solutions For 2022

Crypto Tax In Australia The Definitive 2021 2022 Guide

Adaugă Pin Pe Idea Inspiration